By Richard Branch, Chief Economist

On Friday, November 5, the House of Representatives passed the nearly $1 trillion infrastructure bill, following months of uncertainty. Over the life of the funding, the programs will inject nearly $550 billion in new spending across a multitude of programs such as roads and bridges, water and sewer, broadband internet, rail, and enhancements to the electric grid.

Additionally, the vote also approved a long-overdue five-year authorization for surface transportation (replacing the FAST Act) as well as funding for the Environmental Protection Agency’s water programs. It’s not all about funding, however: There were significant policy changes, such as reducing the time it takes for agencies to issue environmental approvals, which will go a long way to ensuring that these funds will be allocated in a fairly quick fashion.

The infrastructure program is likely to begin paying dividends to the economy as early as 2022, as the new spending begins to flow to the construction sector. The inclusion of a program that is slated to last ten years or more into a forecast window of five years necessitated some assumptions on how this money will be allocated on an annual basis. Dodge has assumed that 80% of funding, $440 billion, will be spent by the end of 2026, with the remainder occurring thereafter. The bulk of funds will be distributed in 2023 and 2024.

It is worth noting that not all infrastructure spending will make its way into construction starts. In other words, nonbuilding construction starts will not increase by the full $550 billion during the next five years since not all activity undertaken by the infrastructure program will fit within the Dodge definition of construction. Equipment purchases, for example, could be legitimate program spending, but would not be included as construction activity. Additionally, program funding may be used to provide access to credit markets, where funds offset interest payments, rather than directly to construction projects.

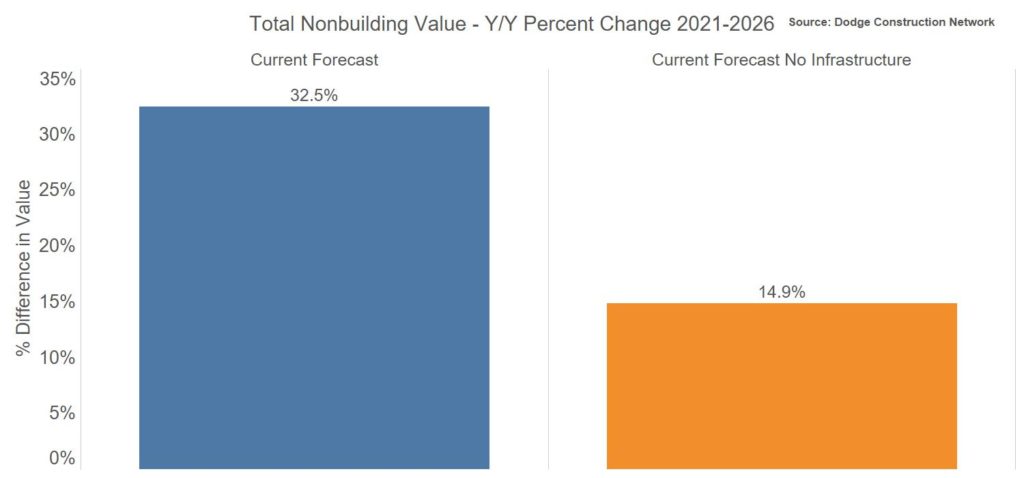

All told, this funding will have a major impact on construction starts in the coming years. How much? Our econometric models suggest that Dodge Construction Network nonbuilding starts will increase by 33% by the end of 2026 (the end of our forecast window), compared to just 15% under a scenario where no infrastructure program is passed. Road and bridge work will be the big benefactor in the program, but all infrastructure categories will win.

This spending amounts to the most important measure directed to the nation’s crumbling infrastructure in nearly 50 years and will go a long way towards allowing construction firms to grow and be more profitable in the coming years. So make sure you have your hard hat, hammer, and other tools ready to go. It’s going to get real busy, real soon.